Many businesses have an amount of cash on hand; in tills, in a cash box or perhaps in a Tupperware box under the counter. This cash is often referred to as "float" and it refers to physical coins and notes.

The amount of cash will vary for a number of reasons, the most common include:

One of the tasks of a careful business operator is in keeping track of these cash movements and reconciling the amount of cash actually present with the amount that can be accounted for by the above types of transaction.

When you record your supplier invoices, receipts and overhead payments you have the option of showing that each was paid by cash. This has been covered in earlier topics in the tutorial.

We have also, briefly seen how bank deposits and withdrawals are recorded in the Setting Up / Cash opening balance topic.

What is needed is a way to pull all of that information together so that you can compare what the system "says" you have on hand with the actual piles of coins and notes that you have on the desk in front of you.

When you first run the Cash Float Reconciliation report you are asked for a date for the report. This would normally be today's date but you can run the report for any date in the past whereupon the cash reconciliation will be done up to that date.

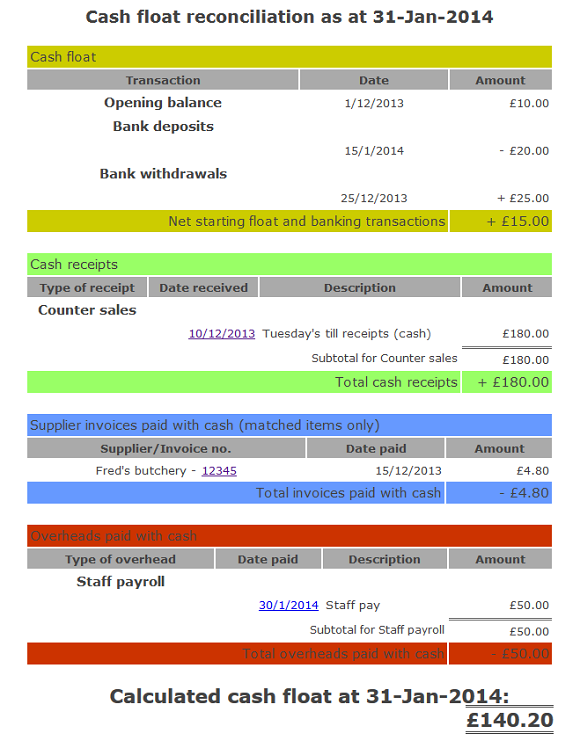

Once the report runs you will see something similar to this:

The report is divided into four sections:

In the first section you can see that we made an opening balance entry on 1st December of £10. This indicates that, on 1st December we counted up all of our cash on hand and it came to £10. This then gives the report a known starting point - on 1st December we KNEW we had £10 in cash.

Note you can enter a opening balance entry at any time, for any date. This is, in effect, the way you can "reset" the cash reconciliation report to a fixed, known point in time with a known amount of cash on hand.

When you run the Cash Reconciliation report it will always start from the first opening balance entry that is dated BEFORE the date of the report. In other words, if you run the report for today's date, it will start from the LAST opening balance entry you made. Anything recorded before that last opening balance entry will be ignored.

The first section also shows that we made a bank deposit and a bank withdrawal.

Next any cash receipts are shown, followed by supplier invoices paid with cash and then any overheads paid with cash.

The bottom line of the report then shows you how much cash you should now have on hand.

The fun begins when the amount of cash you have on your desk is significantly different from the amount the report says you should have. It probably means that you have forgotten to record a transaction in the system but sometimes it may be an indication that something more serious is going on.

This concludes the tutorial for the Finance module.

|

|

|