The term "P&L" in the name of this report stands for Profit and Loss.

This report provides a somewhat different view of your trading performance than did the previous, Trading & VAT Summary, report. This one provides more of an overview and also takes into account your stock holdings at the beginning and end of the report period.

Also, since VAT (if you are registered) has no impact on your business' profit (the VAT you collect and pay out is not yours), it plays no part in this report at all.

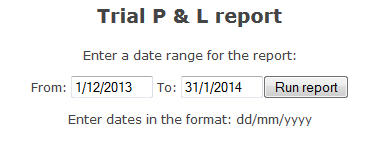

Initially, when you run the report, by choosing the Finance/Reports/Trial P&L option, you are asked for a pair of dates:

The report will look for receipt, invoice and payment transaction between those two dates and also take into account your stock holdings at the beginning and end dates.

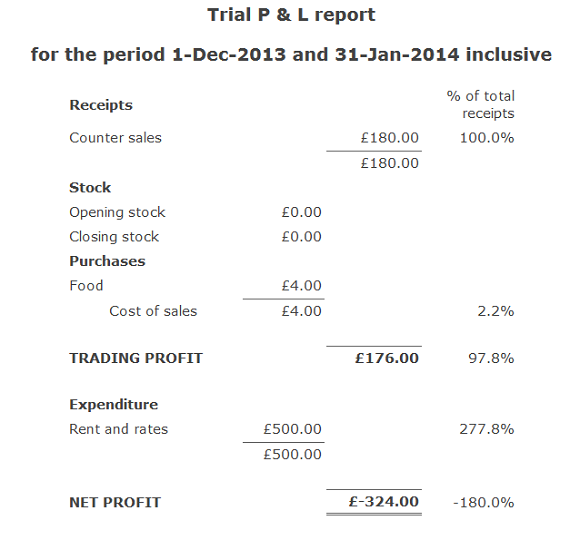

The resulting report summarises all of those transactions and your stock usage to show you a profit and loss for the period. Below is an example of the report produced:

If you compare this report with the output from the previous report you will find some common figures. The counter sales, purchases and expenditure will match the corresponding values on the Trading & VAT Summary report (using the Ex VAT figures).

This report also shows a stock value change by showing an opening and closing stock value. In this example they are both zero but any net change in the stock value will have an impact on the bottom line net profit.

For example, if your purchases were, say, £100 but your stock value had increased in the period from £20 to £40 then your actual cost of sales would be £80, i.e. £20 worth of your purchases were not used up in this period.

On the other hand, if your stock value had DECREASED from £20 to £10 then your actual cost of sales would be £110, i.e. you had to use more than the £100 of purchases in the period.

The right hand column shows you each value on the report as a percentage of total receipts. This is often a useful measure if your business is suffering from a profit margin problem.

As a final note, the report is called a TRIAL P&L since it is not a strict, accounting level P&L report. However, as a routine monitor of your business performance, it provides a fairly simple overview that is taken directly from the records that you enter into the system.

|

|

|