Most catering operations will have an amount of cash on hand. This maybe in the form of a float in the till or perhaps an amount locked away in a cash box in a desk.

The amount of cash on hand at any point in time can be determined if you know three figures:

The amount of cash that you have taken in or paid out will be reflected in other records made using the Finance tools; supplier invoice payments, overhead payments or sales receipts. For each of these you can indicate that they were paid by cash, or that you received cash, if that is the case. If you keep these records accurately then you need take no further action as far as receipts and payments of cash are concerned.

Other types of transaction that will affect the amount of cash you have on hand are bank deposits or withdrawals. Recording these is done in the same way as that described below.

The final piece of the puzzle is to record the amount of cash you have on hand at a specific point in time - a "stock take" of your cash is one way of looking at it. This is the cash opening balance.

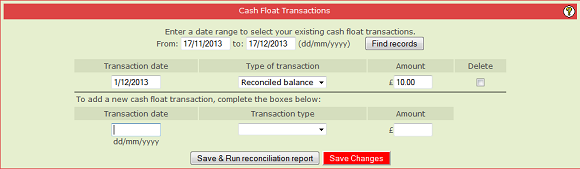

Under the Finance main menu option, the Cash Float Reconciliation option gives you the ability to record the opening balance and any bank transactions.

The process is simple:

In the example above you can see that a Reconciled Balance (i.e. an opening balance) has been entered for £10.00 on 1st December 2013.

As a business operator you will probably want to check your cash situation on a weekly basis and, from time to time, you will need to understand where any discrepancies have come from. The reconciliation report shows you a detailed listing of the cash movements you have recorded in the system so that you can compare that to what you actually have on hand.

Once you have got to the bottom of why there is a difference you will want to make an adjustment so that the system once again shows the correct amount of cash. This is done by simply making another Reconciled Balance entry for the correct amount.

NOTE: You can enter a new Reconciled Balance at any time. The reconciliation report always works forward from the last reconciled balance entry.

|

|

|