Once you have entered the timesheets for your staff the Staff Payroll Report summarises the amount that each person is due as their pay. You can then automatically transfer the total amount into an overhead payment record.

To run the Staff Payroll Report click on the Finance/Reports/Staff payroll option:

Here you will specify the date range for your report. You can enter any date range you wish but typically this will be a week or perhaps a month. You would normally use the time period that you use for paying your staff.

After entering the dates click Run Report.

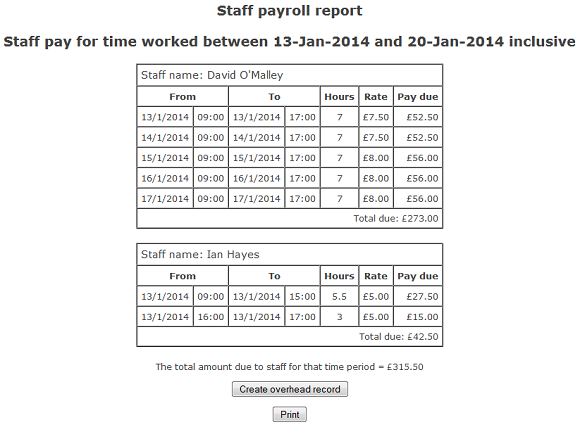

The report lists each member of staff for whom you have entered at least one time sheet during that period.

Under each staff member the individual time sheet records are listed along with the applicable rate and the amount due. The total due for that person is also shown.

Note in the example above for David O'Malley his pay rate changes mid-week. The report reflects this.

The report can be printed or you can click the Create Overhead Record action button to transfer the grand total amount shown at the bottom of the report into a new Overhead Payment record. Only the amount is transferred, you will need to enter the specific date and the overhead category before saving it.

Note that the payroll report calculates ONLY the amount of pay due to the staff member. It does not calculate the tax due on that amount. A formal payroll system needs to be used to ensure that all of the correct deduction rules are applied. However, this report will calculate the amount of pay that each staff member has earned.

Also remember that, as an employer, there may also be some tax liabilities that you must pay. Once again, the formal payroll system will be able to calculate these amounts too and then you will need to manually create an Overhead Payment record for the amount of tax you have to pay.

This concludes the tutorial section on Staff and Payroll. In the final section of this tutorial we will cover the remaining reports available in the Finance module.

|

|

|