The name of this report can be off-putting if you are not VAT registered. However, it also provides a wealth of information about your trading activity, for any period of time you specify, that is relevant to ANY business.

Initially, when you run the report, by choosing the Finance/Reports/Trading & VAT Summary option, you are asked for a pair of dates:

The report will look for receipt, invoice and payment transaction between those two dates.

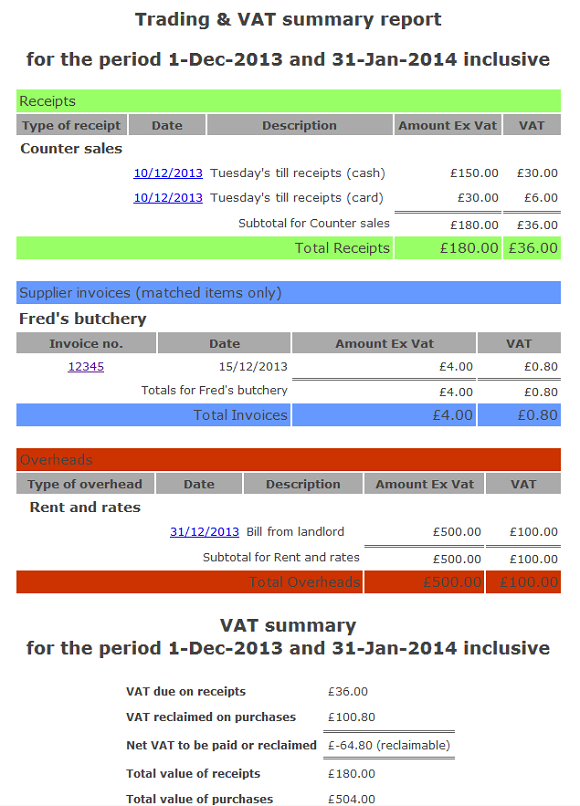

The resulting report itemises and summarises all of those transactions to show you a net trading performance and, if you are VAT registered, it will also show you your VAT liability incurred over that period. Below is an example of the report produced:

As can be seen this report is fairly lengthy and, if it is run over a long period of time (one quarter is usual for VAT liability) it will be even longer. However it contains a lot of information that is vital to your running of the business.

Each individual receipt is listed at the top of the report, subdivided into the various receipt categories that you are using.

Next, each supplier invoice you have entered is listed, subdivided into each separate supplier. Remember that ONLY matched invoice items will be counted.

Finally, each overhead payment record is listed, subdivided into the overhead categories you are using.

Note that each transaction is shown whether or not you have actually paid it or received the payment yet. This is because it is a TRADING report, which is different from a cash flow report.

At the bottom of the report is a summary of everything above it. If you are not VAT registered then the VAT parts of the summary will be shown as zeroes but the total values sums will still be correct.

|

|

|